Listen up, mate. Investing your money is key to building your wealth because it allows you to put your funds into vehicles that can potentially generate significant returns. If you don’t invest, you’ll miss out on opportunities to grow your financial worth. While investing comes with the risk of losing money, if you make wise investment choices, the possibility of making a profit is greater than if you choose not to invest at all.

1- Achieve financial goals

Hey mate, let me tell you something exciting! Investing is an absolute game-changer when it comes to building wealth and reaching those big financial goals. Seriously, it’s like having a secret weapon to make some serious money.

Here’s the deal: when you invest your hard-earned cash in different avenues like stocks, bonds, mutual funds, or real estate, you have the potential to grow your wealth way faster than just relying on plain old savings methods.

Think long-term gains, my friend. Investing is the key to achieving major milestones like owning a sweet house, giving your kids the best education, or living the dream retirement life. Picture this: by putting your money into a retirement account like a 401(k) or an Individual Retirement Account (IRA), you can enjoy some sweet tax advantages. That means your savings can grow tax-free or get taxed at a later date. It’s like supercharging your money so it multiplies like crazy over time. And when retirement rolls around, you’ll have a nice, fat nest egg waiting for you.

But that’s not all! Investing opens up doors to reach other financial goals too. Want to buy a house? Want to make sure your kid gets the best education? By investing in stocks or mutual funds, you have the potential to score higher returns compared to boring old savings accounts. That means more money in your pocket for that down payment on your dream home or to fund your kid’s college tuition.

2- Potential for higher returns

Listen up, my friend, because this part is crucial! Investing is the ultimate game-changer when it comes to making serious money. Here’s why it blows traditional savings accounts out of the water.

You know those savings accounts? Yeah, they offer puny interest rates that barely keep up with inflation. It’s like watching paint dry, my friend. But investing? Oh boy, it’s a whole different ball game.

When you invest in exciting things like stocks, bonds, mutual funds, or real estate, you’re tapping into a world of potential profits. We’re talking higher returns that can make your money grow faster than you ever imagined. Let me break it down for you.

Imagine investing in stocks or mutual funds. Historically, they’ve been known to deliver an average annual return of around 10%. That’s right, my friend, 10%! Compare that to the measly interest rates of savings accounts, and you can see why investing is the way to go.

Now, let’s talk about bonds. While they might not offer sky-high returns like stocks, they’re more like a steady, reliable source of income. Bonds can be a part of your investment portfolio, providing stability while still earning you some decent money.

And don’t even get me started on real estate. Investing in property can be a gold mine, especially if it appreciates in value over time. Talk about a win-win situation: you can potentially earn rental income and enjoy the profits from a property’s value appreciation. It’s like having your cake and eating it too!

3- Beat inflation

Inflation, which is the rate at which the general price of goods and services increases over time, can erode the purchasing power of your money. Traditional savings accounts, which typically offer low-interest rates, may not be able to keep up with inflation, and your money may lose value over time as a result. Investing, on the other hand, can help you stay ahead of inflation by potentially providing higher returns than the inflation rate.

When you invest, your money has the potential to generate returns that outpace the rate of inflation. This means that your investments can help you maintain the purchasing power of your money and ensure that it doesn’t lose its value over time. For example, if the inflation rate is 3% and your investments provide a return of 7%, your investments have effectively grown by 4% in real terms. By contrast, if you kept your money in a savings account that only offered a 1% return, your money would have actually decreased in value by 2% in real terms after accounting for inflation.

It’s worth noting that investing comes with risk and there are no guarantees when it comes to returns. However, investing in a well-diversified portfolio of assets can help mitigate risk and potentially provide returns that keep pace with or exceed the rate of inflation, helping to maintain the purchasing power of your money over time.

4- Diversification

Investing in different types of assets can provide diversification and help spread out your risk. By allocating your investment portfolio across different types of assets, such as stocks, bonds, and real estate, you can potentially reduce the impact of market volatility and minimize your overall risk.

Diversification is a fundamental principle of investing that aims to reduce the overall volatility of your portfolio. By investing in different types of assets, you can spread out your risk across a range of investments, rather than relying on just one or two assets. This can help you weather the ups and downs of the market and potentially reduce the impact of any one asset’s poor performance on your overall portfolio.

For example, if you invest all your money in a single stock and that stock’s price drops significantly, your entire portfolio would suffer. However, if you had diversified your portfolio across several different stocks, bonds, and other assets, the impact of any one asset’s poor performance would be less significant.

Diversification can also help you take advantage of different market conditions and potential opportunities. For instance, when the stock market is performing well, bonds may be underperforming. By diversifying your portfolio, you can potentially benefit from both the stock market’s gains and the stability of bonds.

While diversification can help reduce risk, it’s important to keep in mind that no investment strategy can completely eliminate risk. There is always a chance that your investments could lose value, and past performance is not a guarantee of future results. However, by diversifying your investment portfolio, you can potentially reduce your overall risk and help achieve your long-term financial goals.

5-Take advantage of compounding:

One of the key benefits of investing is the ability to take advantage of compounding, which can help you achieve your financial goals faster. Compounding is the process of reinvesting your returns, which allows you to earn not only on the original amount invested but also on the returns generated from that investment over time. This creates a snowball effect that can lead to exponential growth in your investments.

For example, let’s say you invest $10,000 in a mutual fund that generates a 10% annual return. After the first year, your investment would be worth $11,000. If you reinvested that $1,000 in returns and earned another 10% the next year, your investment would be worth $12,100. Over time, this compounding effect can lead to significant growth in your investments and help you achieve your financial goals faster.

Compounding can be particularly powerful over the long term. By investing for many years or even decades, you can potentially earn significant returns on your investments, which can compound over time to create a substantial nest egg. This is why it’s often recommended that investors start saving and investing early, to take advantage of the long-term benefits of compounding.

Of course, it’s important to keep in mind that compounding can work both ways. Just as it can lead to exponential growth in your investments, it can also amplify any losses you may experience. This is why it’s important to invest wisely and diversify your portfolio to help mitigate risk. However, by taking advantage of compounding and investing for the long term, you can potentially achieve your financial goals faster and build long-term wealth.

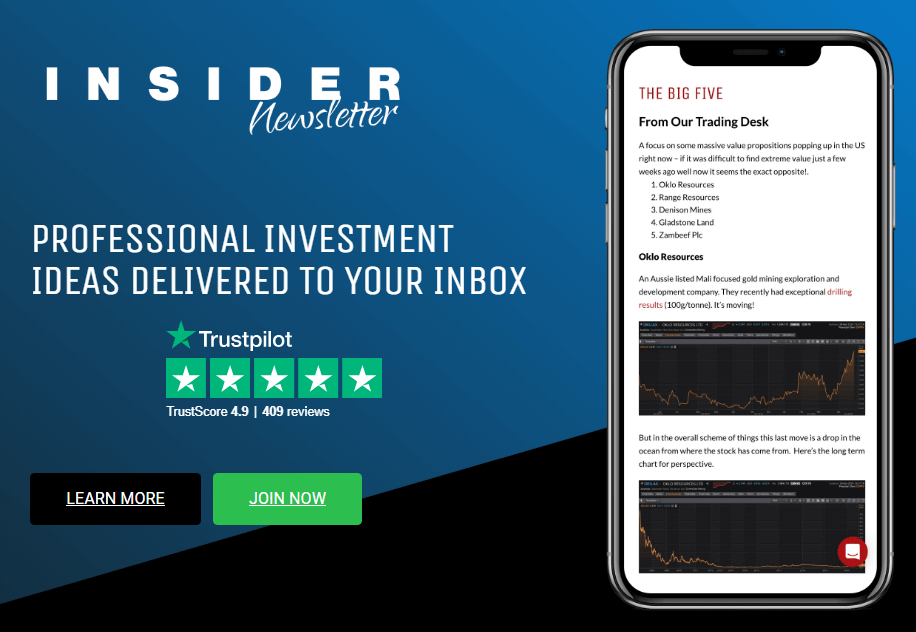

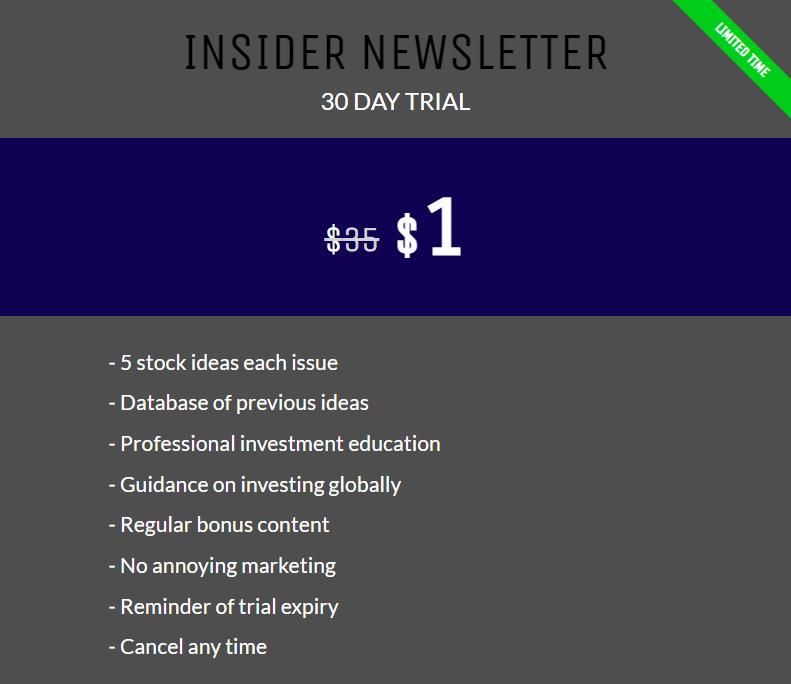

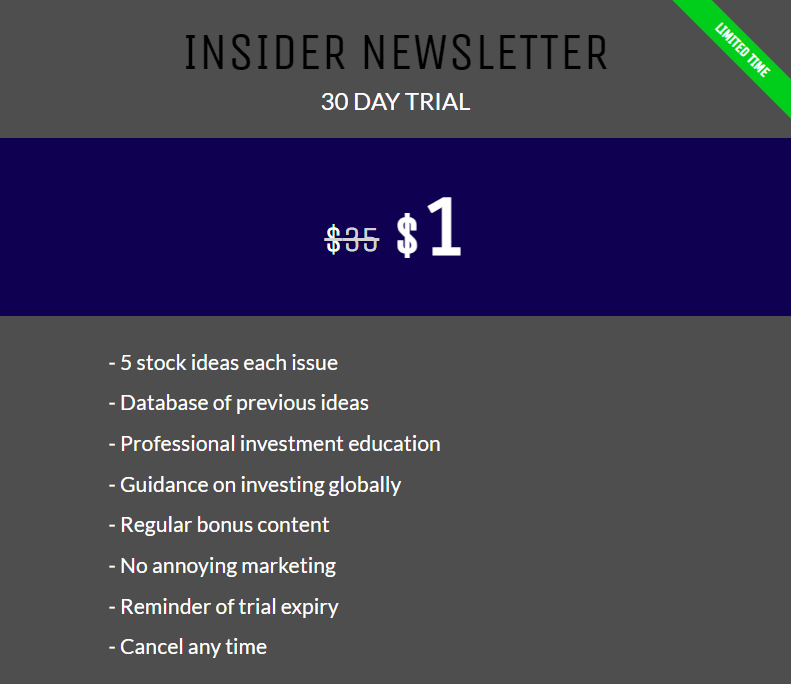

Why investing newsletters?

However, investing comes with risks, and there are no guarantees when it comes to returns. To mitigate risk and maximize returns, it is essential to stay up-to-date on market trends, economic indicators, and investment strategies. One way to do this is by subscribing to an investing newsletter.

Investing newsletters can provide you with valuable insights, expert analysis, and actionable investment advice that can help you make informed decisions about your investments. They can help you stay on top of market trends and economic indicators, providing you with valuable information that can help you make better investment decisions.

Moreover, investing newsletters can help you identify potential investment opportunities and help you diversify your portfolio. By providing you with information about different types of assets, investing newsletters can help you spread out your risk and maximize returns.